Global Investment Bank Automates GRC Processes with ViClarity

October 21, 2024

Identifying the Need for End-to-End GRC Automation

A leading global investment bank offering wealth management, investment banking, asset management and trading services in multiple countries recently embarked on a digital transformation project that involved multiple processes in its governance, risk and compliance (GRC) frameworks.

Due to the diversity of its portfolio, the complexity and scale of the bank’s processes across business lines necessitate stringent risk management, compliance and vendor oversight to ensure regulatory adherence and operational efficiency.

"As the bank expanded its operations, the existing processes struggled to scale, resulting in longer response times, increased costs and a greater burden on staff."

"As the bank expanded its operations, the existing processes struggled to scale, resulting in longer response times, increased costs and a greater burden on staff."

-Head of Compliance, Global Investment Bank

Easing Challenges Created by Manual Processes

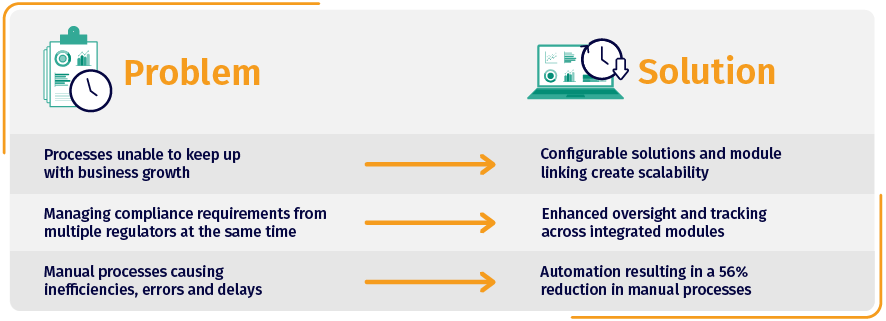

The bank faced significant challenges in managing its risk, compliance and vendor management processes. One issue was due to the breadth of global operations in play across multiple countries. The bank needed to comply with a wide variety of regulatory requirements, which created a complex compliance landscape with varying standards, timelines and reporting requirements.

Previously, the bank’s risk management and compliance processes were primarily manual, leading to inefficiencies, errors and delays. Teams stored vendor and outsourcing data in disparate systems, making it difficult to gain a comprehensive view of third-party risks.

The manual nature of these processes increased the risk of human error, exposing the business to potential compliance breaches, financial penalties and reputational damage. As the organization continued to grow its operations, the existing processes struggled to scale, resulting in longer response times, increased costs and a greater burden on staff.

"In recent years, the bank has grown significantly with new service offerings, meaning our risk and compliance landscape also grew. ViClarity was seen as a solution provider that could keep up with our ever-growing and changing requirements."

"In recent years, the bank has grown significantly with new service offerings, meaning our risk and compliance landscape also grew. ViClarity was seen as a solution provider that could keep up with our ever-growing and changing requirements."

-Head of Compliance, Global Investment Bank

Benefitting from the Added Value of Automation

To address these challenges, the bank implemented ViClarity’s automated solutions for risk management, compliance and vendor management and outsourcing processes. ViClarity’s platform introduced a unified, configurable and scalable solution that transformed the bank’s approach to GRC.

The staff experienced significant improvements to their processes as a result of onboarding ViClarity. Automating processes reduced manual efforts by 56%, allowing teams across the organization to focus on higher-value activities.

The bank’s reports are now updated continuously through ViClarity’s embedded Power BI reporting suite. With Power BI available inside the ViClarity platform, key stakeholders have the flexibility to see reports across departments and locations in real time.

"The implementation has been very successful. ViClarity’s platform provided us with the tools needed to maintain our reputation as a leader in the financial services industry while ensuring robust compliance and risk management across our global operations."

"The implementation has been very successful. ViClarity’s platform provided us with the tools needed to maintain our reputation as a leader in the financial services industry while ensuring robust compliance and risk management across our global operations."

-Head of Compliance, Global Investment Bank

Ready to learn more about ViClarity’s configurable, integrated solutions? Reach out to us or request a demo!

Download Case Study

Back