Clark County Credit Union Revamps Audit Process with ViClarity

September 19, 2023

Clark County Credit Union, in operation since 1951, serves over 50,000 members in Clark County, Nevada. Its mission is to give members ownership over how they reach their financial goals, and the organization was recognized as Nevada’s Best Credit Union by Forbes for the third time in 2023.

Just four years ago, Clark County Credit Union started a compliance team to help manage regulatory demands as the needs of their members grew. Keri Bach, VP Director of Compliance & BSA Officer, began as the only compliance officer on the team and had years’ worth of audits and compliance tracking and reporting to tackle.

Now CCCU uses ViClarity’s software platform to help manage its compliance and audit programs, resulting in a more efficient and simplified process. Gone are the days of using spreadsheets and having to monitor the progress of document reviews and action steps manually.

Struggling with Spreadsheets

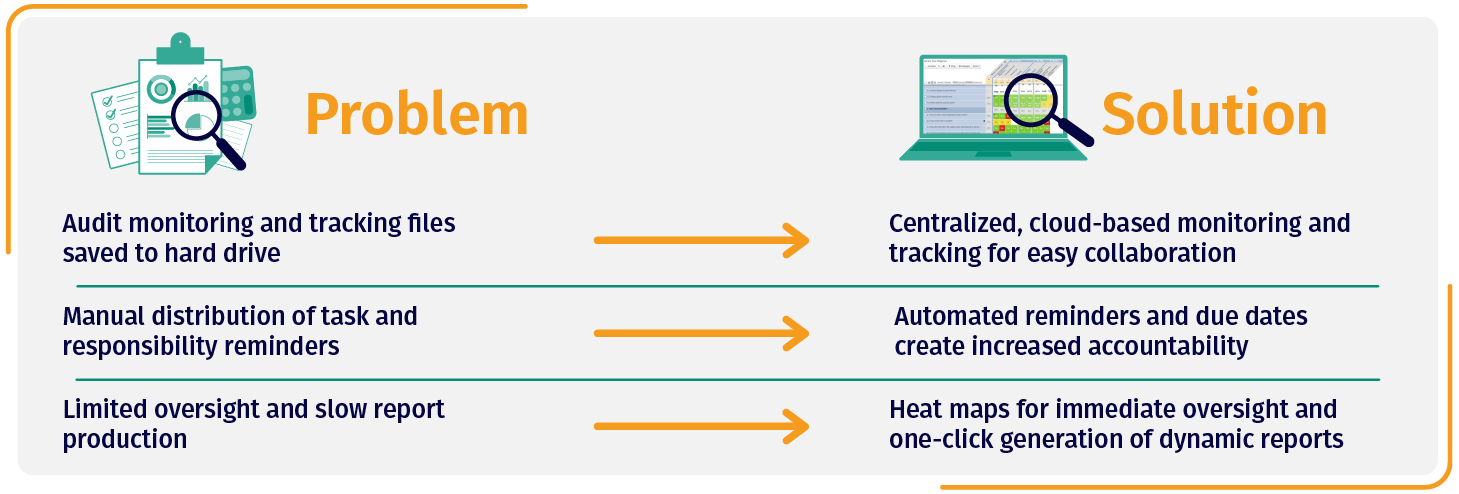

When Bach started at CCCU, she was the compliance team. She was responsible for knocking down a backlog of audits from the past four years, including status reports and follow-ups. Bach also tackled the implementation, tracking and monitoring policies and processes to comply with new and updated regulations. And she did it all with spreadsheets — a process that worked, but that was inefficient and warranted change.

“We got to the point where we had 500 spreadsheets on one computer and then would switch to a different computer and no longer have access to those files anymore — we really needed something more centralized,” said Bach.

By implementing ViClarity’s centralized and automated technology platform, Bach created a more visible and accessible audit process. Now when someone leaves the office for a couple days, there’s no worry about handing off the right sheet or falling behind, because everyone on the team has centralized access to the right data and audits with the most accurate information.

Transforming Audit Processes

Bach’s need to stay on top of audits in an organized and efficient manner was the primary reason Clark County Credit Union started looking for a technology solution.

“We just needed something,” said Bach. The team was keeping up, but knew there was a better, more proactive approach to managing audits efficiently. When researching potential solutions, Bach identified accountability, visibility and accessibility as the most important factors. With spreadsheets, she was always chasing down people and numbers in an attempt to capture the most accurate information.

"I'm huge on accountability. [ViClarity's platform] takes reminding and nudging people about their responsibilities off my plate and gives the individual team members more ownership over their tasks," said Bach.

The ViClarity platform makes it easier for CCCU’s compliance team to delegate tasks with clear distinctions in responsibilities and enhances their overall communication, time management and performance.

Tackling Reg CC Tracking & Reporting

Bach and her team use ViClarity’s Compliance Management and Audit Management solutions to manage and track all monthly internal audits. Most importantly they use these modules to track their Reg CC audit — a process that used to tie up lots of time as the team collected samples daily and then generated comprehensive reports.

“Now we can generate reports right out of that [ViClarity audit management module] and send them over to our AVP of Operations for feedback. That takes a lot of steps out of our process, so we can just click a button and send the report off instead of having to chase down samples or explain them – it’s just right there,” said Bach.

CCCU is thrilled to use ViClarity’s software to streamline the way their team works. They’ve been able to enhance communication and delegation for a more accountable culture (no one needs to babysit the data!) and the system efficiently produces accurate reports that their board, examiners, and senior management team appreciate and value.

This operational transformation allows the credit union to focus on more confident analysis and decision making so the team can continue to provide excellent service and products to members.

Download Case Study

Back