Coopera Saves Time & Enhances Reporting with Custom ViClarity Solution

March 26, 2024

Coopera Consulting was founded in 2006 by the late Hispanic community activist Warren Morrow and it is now a full-service multicultural analytics and consulting firm dedicated to helping credit unions find meaningful ways to be inclusive in their business practices.

One of the first steps in each of Coopera’s consulting partnerships is an Organizational Equity Assessment (OEA). Through the OEA, Coopera identifies a credit union’s current capacity to reach multicultural communities and creates a starting point to improve their internal processes. It establishes a baseline for the entire consulting partnership and determines what type of guidance the credit union needs from Coopera.

After years of tackling the OEA manually, Coopera turned to ViClarity for automation and reporting improvements.

“We saw how ViClarity’s platform worked well for lots of other processes in the credit union space, including vendor management and compliance and audit tracking,” said Victor Miguel Corro, Coopera’s CEO. “We were thrilled when the ViClarity team agreed to work with us to configure a solution to meet our specific needs for the OEA. Their willingness to really learn our business and pain points and customize the platform for us demonstrated their commitment to true partnership.”

Process Automation Benefits Everyone

The OEA is a crucial step in Coopera’s process. It comprises a series of yes or no questions that allows analysts to understand the internal practices a credit union has implemented to reach multicultural communities. In the past, Coopera’s point of contact at an organization had to talk with several different departments, like human resources and lending, to complete the form.

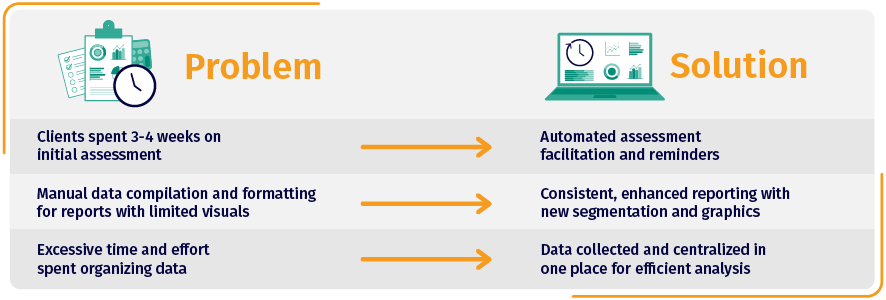

“The time it takes to complete the checklist has decreased significantly now that we’re using the ViClarity platform,” said Jennifer Esperanza, Sr. Director of Organizational Culture and Strategy at Coopera. “Previously we would see times as long as 3 to 4 weeks, but now clients can get [the OEA] done in a week. I used to have to chase down clients and send email reminders asking after the status of the OEA, but now I can just schedule reminders through the platform.”

In addition to the time spent by Coopera’s clients, Esperanza and the Coopera team dedicated a large amount of effort to manually formatting and analyzing the old Excel sheets before and after the client inputs. There were rows and columns relating to backend formulas that needed to be hidden and protected from client view. Now ViClarity’s system completes the calculations automatically and Coopera no longer needs to manually hide and protect certain elements.

With ViClarity, the Coopera team sends out one link to a client with instructions about how to complete the OEA and that point of contact can forward the link to each department in their credit union as needed. The collaborative environment enables Coopera to decrease the overall time spent on the OEA so they can get started sooner on providing valuable guidance based on the data.

Dynamic Reporting Increases Visualization & Supports Faster Decision-Making

After completing the OEA, Coopera compiles a report of all the data from the questionnaire and from an internal survey about inclusive practices. This report shows Coopera’s clients how they are doing in their multicultural efforts based on a three-tiered scale: emerging, discovery, and best practice.

“Through the new report, we give clients a score that corresponds to how they performed in each area of the questionnaire, which we could not do prior to using the ViClarity platform. We were only able to provide an overall score rather than segmenting it out,” said Esperanza.

In the report created through ViClarity’s software, Coopera can separate scores for process, personnel, products, and marketing, to name a few. This level of detail allows Coopera to easily pinpoint and display areas where a client is excelling and areas that need improvement.

“The increased visualization helps the client to determine where best to allocate budget or make changes,” said Esperanza.

Another component of the OEA is a personnel survey. This fully anonymous survey is conducted through the ViClarity system and allows the client’s staff to contribute their perspectives on inclusivity at their organization. ViClarity’s dynamic reporting capability gives Coopera the tools to easily compile and display the results.

In addition to enhanced visuals, ViClarity saves Coopera time in creating the reports their team presents to clients. Esperanza said this about the company’s previous report-building process: “There was a lot of additional formatting we had to do. We would find these areas where credit unions were doing really well and areas that needed attention, and then moving all those recommendations from Excel to presentation slides and then into a PDF format – it always got really messy.”

The True Value of Time Savings

With ViClarity, Coopera has transformed manual, cumbersome and time-consuming processes into an efficient structure with enhanced reporting capabilities. The ease of the new system allows Esperanza and her colleagues to spend their energy on what they do best — providing expert guidance to help credit unions better promote diversity and deliver inclusive products and services to their communities.

Want to know whether ViClarity can configure a solution to meet your specific business needs? Reach out to us!

Download Case Study

Back